The Elevations Story: How This Credit Union Halved Time Spent on Audit Admin and Reporting

Elevations Credit Union achieved over 50% efficiency gains to expand its audit scope with AuditBoard’s connected risk platform. By centralizing audit planning, risk assessment tracking, and compliance frameworks, they are able to save time on budget reconciliation, admin tasks, and executive reporting to provide greater assurance across critical business risks. Learn how this team elevated their audit and risk program in this case study.

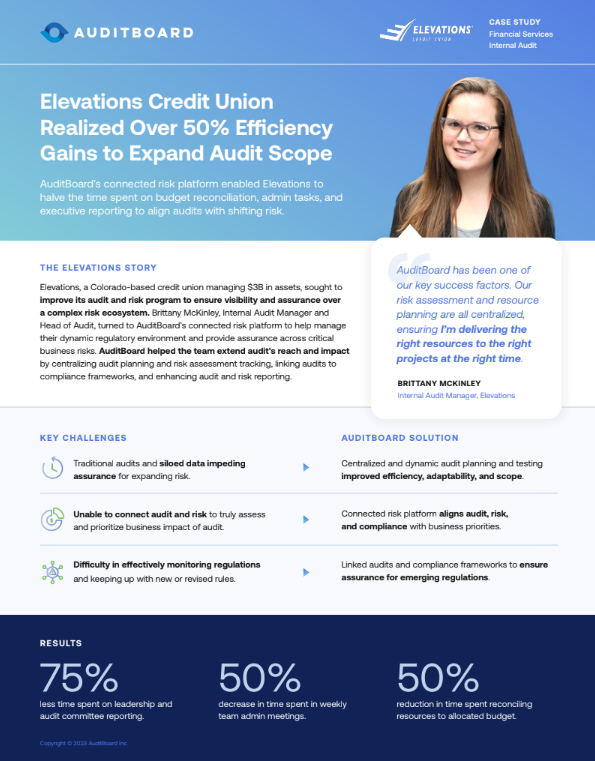

Elevations, a Colorado-based credit union managing $3B in assets, sought to improve its audit and risk management program to ensure visibility and assurance over a complex risk ecosystem. Brittany McKinley, Internal Audit Manager and Head of Audit at the company, turned to AuditBoard’s connected risk platform to help manage a dynamic regulatory environment and provide assurance across critical business risks. AuditBoard helped the team extend internal audit’s reach and impact by centralizing audit planning and risk assessment tracking, linking audits to compliance frameworks, and enhancing audit and risk reporting.

The key challenges they were facing included that 1) traditional audits and siloed data were impeding assurance for an expanding risk environment, 2) they were unable to connect internal audit and risk management to truly assess and prioritize the business impact of audit, and 3) they were experiencing difficulty in effectively monitoring regulations and keeping up with new or revised rules.

Here are some of the ways AuditBoard was able to help the team overcome these challenges and improve business outcomes:

Increasing Efficiency and Agility

Traditional audits, limited tools, and dispersed data made it difficult for Elevations to provide continuous assurance for an expanding risk landscape. AuditBoard helped them overcome these challenges by enabling better cross-functional collaboration, flexible and automated audit planning, and robust resource planning. The easy-to-use interface and self-help training accelerated adoption.

Elevations, a Colorado-based credit union managing $3B in assets, sought to improve its audit and risk management program to ensure visibility and assurance over a complex risk ecosystem. Brittany McKinley, Internal Audit Manager and Head of Audit at the company, turned to AuditBoard’s connected risk platform to help manage a dynamic regulatory environment and provide assurance across critical business risks. AuditBoard helped the team extend internal audit’s reach and impact by centralizing audit planning and risk assessment tracking, linking audits to compliance frameworks, and enhancing audit and risk reporting.

The key challenges they were facing included that 1) traditional audits and siloed data were impeding assurance for an expanding risk environment, 2) they were unable to connect internal audit and risk management to truly assess and prioritize the business impact of audit, and 3) they were experiencing difficulty in effectively monitoring regulations and keeping up with new or revised rules.

Here are some of the ways AuditBoard was able to help the team overcome these challenges and improve business outcomes:

Increasing Efficiency and Agility

Traditional audits, limited tools, and dispersed data made it difficult for Elevations to provide continuous assurance for an expanding risk landscape. AuditBoard helped them overcome these challenges by enabling better cross-functional collaboration, flexible and automated audit planning, and robust resource planning. The easy-to-use interface and self-help training accelerated adoption.

- Key result: 75% less time spent on leadership and audit committee reporting.

Integrating Risk Assessments and Audit Planning

Previously, Elevations struggled to connect audit and risk, hindering their ability to accurately assess business impact. AuditBoard centralized audit planning, tracking, risk assessments, and reporting to improve data integrity and visibility. Real-time visibility into their dynamic risk landscape allowed the team to scale and extend assurance for emerging risk as regulations changed and reallocate resources leveraging AuditBoard’s timesheets feature.

Previously, Elevations struggled to connect audit and risk, hindering their ability to accurately assess business impact. AuditBoard centralized audit planning, tracking, risk assessments, and reporting to improve data integrity and visibility. Real-time visibility into their dynamic risk landscape allowed the team to scale and extend assurance for emerging risk as regulations changed and reallocate resources leveraging AuditBoard’s timesheets feature.

- Key result: 50% reduction in time spent reconciling resources to allocated budget.

Download a copy of the case study to learn more about the success Elevations Credit Union experienced using AuditBoard!

Copyright © 2023. All rights reserved.